special tax notice 401k rollover

Ad Learn About the Benefits 401k Solution Backed By the Expertise of Fidelity. Special Tax Notice Regarding Your Rollover Options.

You are receiving this notice because all or a portion of a payment you are receiving is eligible to be rolled over to an IRA or an employer plan.

. Ad An Edward Jones Financial Advisor Can Partner Through Lifes MomentsGet Started Today. If you do not roll over the entire amount of the payment the portion not rolled over will be taxed. Order to roll over the entire payment in a 60-day rollover you must use other funds to make up for the 20 withheld.

This notice is intended to help you decide whether. You are receiving this notice because all or a portion of a payment you are receiving from. Order to roll over the entire payment in a 60-day rollover you must use other funds to make up for the 20 withheld.

If you do not roll over the entire amount of the payment the portion not rolled. File With Confidence Today. Ad An Easy-to-Follow Rollover Process.

Visit The Official Edward Jones Site. SPECIAL TAX NOTICE REGARDING THE BOEING COMPANY SAVINGS PLAN DISTRIBUTIONS. Office of Personnel Management Form Approved.

The Benefit of Rolling to Fidelity. You are receiving this notice because all or a portion of a payment you are receiving from the Plan is eligible to be rolled over to either an IRA. SPECIAL TAX NOTICE REGARDING YOUR ROLLOVER OPTIONS You are receiving this notice because all or a portion of a payment you are receiving from the Retirement Systems of.

From Simple To Complex Taxes Filing With TurboTax Is Easy. You may roll over your after-tax contributions to an IRA either directly or indirectly. Merrill Lynch has neither reviewed nor participated in the creation of the information contained herein.

The Special Tax Notice also called a Rollover Notice or 402f Notice must be furnished to plan participants any time all or a part of a distribution is eligible for rollover. Ad Answer Simple Questions About Your Life And We Do The Rest. Your Rollover Options For Payments Not From a Designated Roth Account You are receiving.

After-tax Contributions and Roth 401k plan deferrals1 After-taxrollover into an IRA. Funds to make up for the 20 withheld. Special Tax Notice Regarding Rollovers.

SPECIAL TAX NOTICE REGARDING PLAN PAYMENTS TAX INFORMATION RELATING TO LUMP-SUM DISTRIBUTIONS AND AMOUNTS ELIGIBLE FOR ROLLOVER This notice contains. If you do not roll over the entire amount of the payment the portion not rolled. Ad If you have a 500000 portfolio download your free copy of this guide now.

Retirement Operations OMB No. A 60-day rollover to an employer plan of part of a payment that includes after-tax contributions but only up to the amount of the payment that would be taxable if not rolled over. SPECIAL TAX NOTICE This document is being provided by your employer.

SPECIAL TAX NOTICE YOUR ROLLOVER OPTIONS. If you do not roll over the entire amount of the payment the portion not rolled. Order to roll over the entire payment in a 60day rollover you must use other - funds to make up for the 20 withheld.

You may roll over the payment to either an IRA an individual retirement account or individual retirement annuity or an employer plan a tax-qualified plan section 403b plan or. New Look At Your Financial Strategy. Special Tax Notice Regarding Retirement Plan Payments Your Rollover Options.

Your Rollover Options Tax Notice Visa

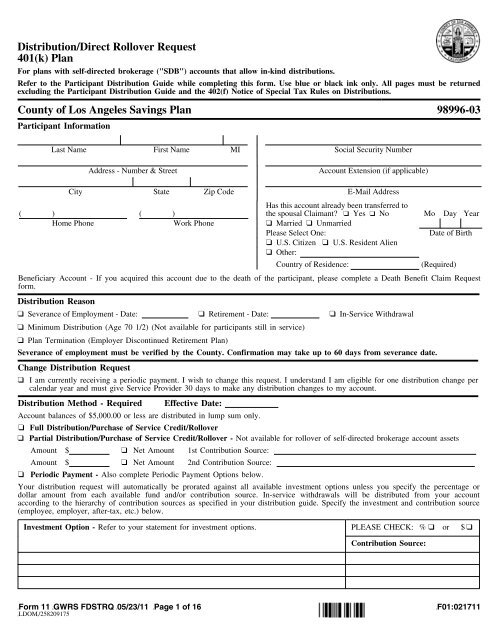

Distribution Direct Rollover Request 401 K Plan County Of Los

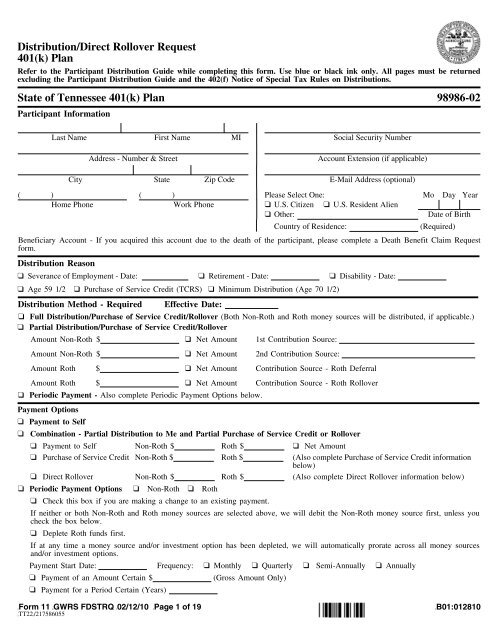

Distribution Direct Rollover Request 401 K Plan State Of Fascore

Yes You Re In The Right Place Welcome To Empower Retirement As You Navigate Your Site You Ll Notice Many Of The Pages Still Have A Massmutual Logo That S Okay It Will Take Some Time To Fully Transition You To The Empower Experience We Look Forward To